The Digital Workspace

Leverage the Human Factor in your digital channels

Leverage the Human Factor in your digital channels

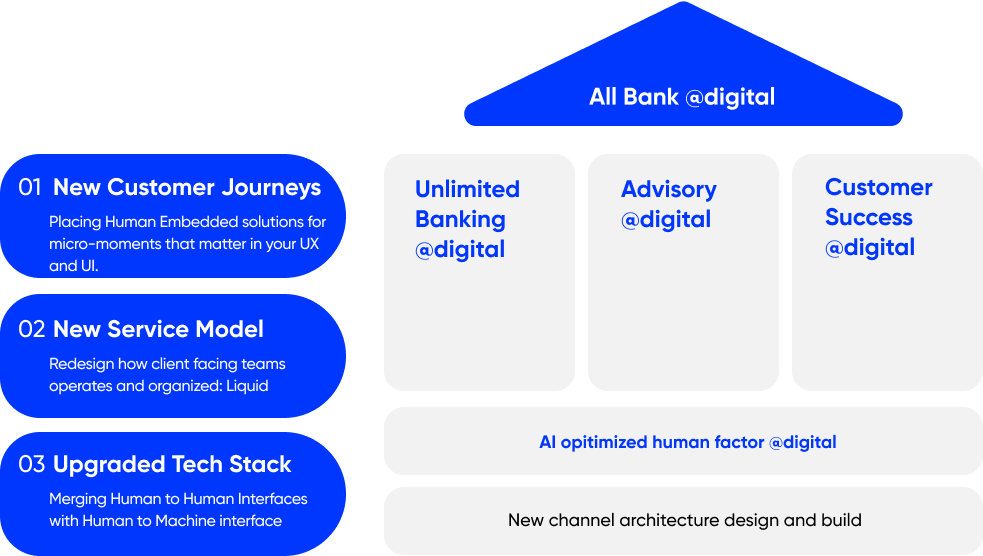

Thru digitization journey almost all companies successfully moved their customers to digital service channels… Great news! But they left their top capability locked in offices: Human Factor. Global trends are urging us to solve this. Trends such as the rise of remote working, competitive economics of pure digital players, brands having difficulties sustaining trust relationship on digital channels and idea of metaverse becoming a reality are urging for a new solution. DefineX redefined the Digital Channels to address all and this time with Human, being a integral part of digital channels.

Digital banking without the human factor is a mobile ATM. If you place a machine in front of your customers instead of a bank, they will treat your bank as they treat their fridges.

Limited banking is inherent in digital

Limited banking is inherent in digital

Advisory is locked away from the customer

Advisory is locked away from the customer

The customer success model is unperforming

The customer success model is unperforming

Inefficiently managed banking workforce

Inefficiently managed banking workforce

Forget multichannel, omnichannel or all other names that describe a patchwork of channels. We design and build a new digital space where your employees, customers, and stakeholders meet and operate. This space is not your digital banking channel; this is your bank now existing digital with all human factors included.

More Sales Opportunity

More Sales Opportunity

We create new sales points with a constant human touch eliminating challenges caused by limited banking problems and missed opportunities on credit, sales and investment products.

Digital Retention

Digital Retention

Retain digital natives through digital workspace without demanding a branch visit to solve digital gaps with human-assisted bridges. Gain insight on what to digitize.

Optimized Branch Workforce

Optimized Branch Workforce

Cut silo-driven inefficiency. Deploy where and when necessary. Move away from generic RM to SMEs and make them available when needed. Extend to contextual banking.

Customer & Employee Satisfaction

Customer & Employee Satisfaction

Expect an increase in NPS. One-click access to all banking needs will take of hyper-care customers. Working from home on sales-oriented tasks will improve RM's efficiency and satisfaction.

Corporate customers are a significant source of revenue for banks, accounting for more than 60% of their income. Despite this, most banks have chosen to prioritize the consumer segment in their digitalization efforts as some C-level KPIs have been the number of digital customers.

DiscoverCreating an automated system for Letter of Credit Advising Bank processes increased income and saved substantial time

DiscoverTwo hundred fifty digital sales opportunities in 3 key areas resulted in a 26% increase in active digital customers.

Discover