An optimum technology stack with a proven business case and solid roadmap was delivered, laying the foundation for a growth-oriented, data-driven marketing operating model.

Banks need to use data effectively to acquire new customers and serve their customers with relevant and engaging experiences. However, complex data governance, multiple systems working in silos and dispersed marketing tools make this impossible. To make things even more complicated, global and local regulations governing how companies are required to handle data are evolving quickly and need to be addressed to create a sustainable Marketing Technologies stack..

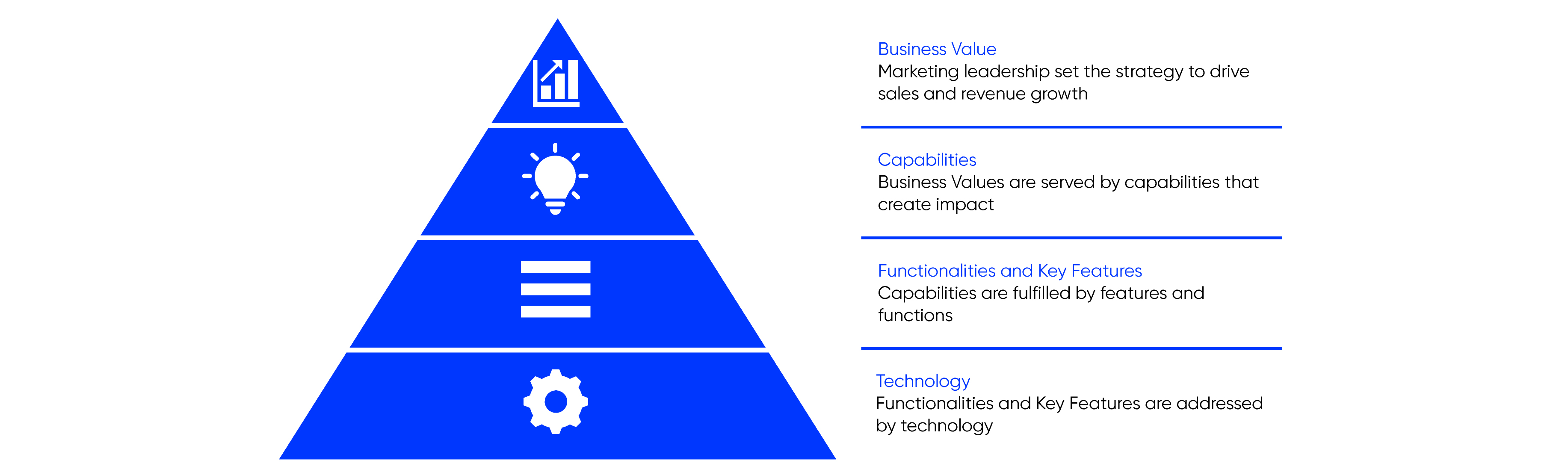

The need for data-driven marketing and increased variety of tools in the market makes Marketing Technologies landscape more complicated. Different marketing and advertising platforms are adding new features continuously and becoming competitors. Data transfer among systems and the need for integration are inflated. Therefore, a comprehensive approach, from customer attraction to interaction and conversion to measurement, is required to design and execute digital marketing efficiently.

We have collaborated closely with our client to define their new MarTech Stack.

• Conduct Current State Assessment: Health-check of current MarTech Stack, identification of business needs and opportunities

• Evaluate Potential Solutions: Identification of potential vendors, evaluation based on functional/ technical/ regulatory requirements

• Design Target MarTech Stack: Definition of target MarTech stack, identification of gaps and creation of backlog, simulation of use cases on selected products

• Develop a Roadmap: Preparation of business case and execution roadmap

By putting business value first and understanding the challenges and dynamics within the organization, we were able to deliver an optimum technology stack with a proven business case and solid yet aggressive roadmap. These efforts lay the foundation for a growth-oriented, data-driven marketing operating model that resulted in: • Unified customer profiling with real time data collection by synchronizing 1st, 2nd, and 3rd party data, • Enhanced targeting of campaigns by using programmatic display advertising, • Ability to reach look-a-like audiences based on existing customer profiles, • Improved customer interactions with real time communications to right segment at the right time, • Increased conversion rates with retargeting scenarios, • Empowered marketers with easy-to-use platforms for segmentation, real-time decisioning, and activation.

Ramp Up Digital Sales Opportunities at Your Bank to Achieve 26% Increase in Customers

Two hundred fifty digital sales opportunities in 3 key areas resulted in a 26% increase in active digital customers.

DiscoverHow did IsBank save 67,351 hours a year by automatizing the financial analysis process?

According to research by Forrester, inefficient processes cost organizations up to 30% of their annual revenue, and digitalization can save up to 90% on operational expenses. Therefore, almost all companies are heading toward digital transformation. Banks are no exception.

DiscoverReduce Your Telco Product Catalog Complexity Through Product Rationalization

In the current telecommunications industry, high customer penetration and increased competition force product managers to introduce new personalized offerings regularly.

Discover